Money Concepts

Vocab to Remember

Defining characteristics of money

- Medium of exchange

- Store of value

- Unit of account

Forms of Money

- Commodity money

- Circulating private bank notes

- Commodity-backed paper currency

- Fiat money

- Transactions deposits at banks

Measures of the Money Supply

| MB | M1 | M2 | |

|---|---|---|---|

| Reserve Balances | ✅ | ||

| Currency in a bank vault | ✅ | ||

| Currency in my pocket | ✅ | ✅ | ✅ |

| Checking accounts | ✅ | ✅ | |

| Savings accounts | Since May, 2020 | ✅ | |

| Time deposits | ✅ |

For more details, take a look at this page from the Federal Reserve: Money Stock Measures - H.6 Release

The Federal Reserve also use to publish a measure called M3, but decided that it wasn’t worth the effort.

How does the government actually change the money supply?

- Helicopter money: Increase the money money supply by decreasing taxes or equivalently increasing transfers.

- Seignorage: Government prints money to buy stuff.

- Open market operations: Increase money supply by decreasing government debt (ie by purchasing bonds).

- Quantitative Easing: Like Open Market Operations, but with longer-term assets.

(But note that the Federal Reserve doesn’t use the Money Supply as their main policy target. Rather than using OMO to set the money supply to some specific amount, the Fed has interest rate targets, and uses money-supply affecting policy as one of their tools to achieve those interest-rate targets. You can read about the details of how the Fed implements monetary policy here.)

Some Amusing Historical Context

This section is a WIP.

The origins of money

In the broadest sense, money is simply any object or social technology that acts as a medium of exchange, store of value, and unit of account. Money is a prehistoric phenomenon, invented and re-invented in many different times and places, so we can’t point to some specific instance where money was thought up. But we can speculate about money’s evolution from things that are moneyish.

- Barter networks converging to use specific commodities as mediums of exchange. As observed in trade networks in the Pacific, or with cigarettes in Prisoner of War camps.

- The formalization of gift economies.

- Some specific store of value, such as jewelry, acquiring a prestige that leads people to value other things in terms of comparison.

- A context-specific valuation, such as dowrie or weregild or taxes, spreading to become a more general unit of account.

Examples of Commodity Currencies

Monetaria Moneta, the Money Cowrie. The shells of these snails were widely used as money.

Left: Live money snail. CC-BY-SA-5 Philippe Bourjon.

Center: Ancient Chinese Shell Money. CC-BY-SA-3 PHGCOM.

Right: Lithograph of traders using shells. 1845

- Spade Money, the earliest “coins”.

- Knife Money

- Lydian Coins

Lydian Coinage from 2600 years ago.

Left: Ancient Chinese Shell Money. CC-BY-SA-3 Classical Numismatic Group, Inc. Right: own photo.

- Beaver Pelts

- Rai Stones

- Cacao. (Ek Chuaj)

Ancient Accounting Technology

- Accounting Tokens

- Tally Sticks

Paper Money

- Jiaozi

- Early US Currency

What happens when there isn’t enough paper money?

From the collection of Shawn Hewitt. Own photos.

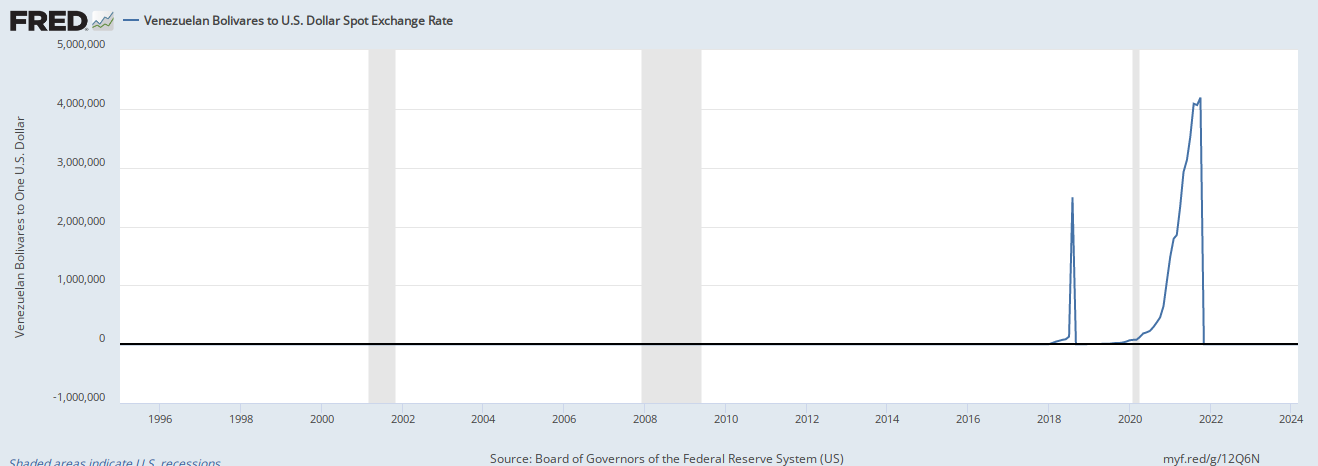

What happens when there’s too much paper money?

Hyperinflation. Examples:

- Venezuela

- Zimbabwe

- Hungary

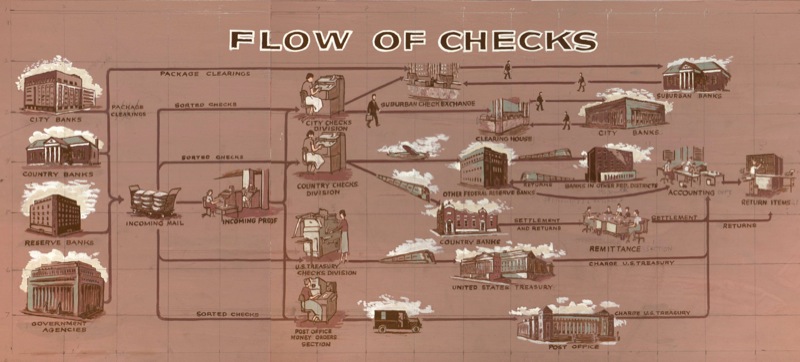

Transactions Accounts and the Future

Nowadays, most money is in the form of checking or savings accounts, where the thing being traded is just entries in a ledger.

Over the last decade, cryptocurrencies like Bitcoin have made quite a buzz. The underlying technology, the blockchain, is a way of maintaining a ledger without a trusted authority.

And now there are talks about countries creating central bank digital currencies. (Which wouldn’t necessarily need to use a blockchain because they’d be administered by a central authority.)

Further reading: The Future of Money and Its Implications for Society, Central Banks, and the International Monetary System

A few entertaining reads

- A Survey Of Primitive Money, by Alison Hingston Quiggin, 1949. An anthropological description of many forms of money and money-adjacent phenomena.

- Money: The Unauthorised Biography, by Felix Martin, 2013. A popular modern account about the history of money. Martin tells the story that money in its modern form arose when Mesopotamian accounting technology collided with Greek social notions of universal value. A poetic take, if one a bit too tidy for my taste.

- The Cambist and Lord Iron: A Fairy Tale of Economics, by Daniel Abraham. In this short story, the titular cambist is tasked with calculating three very strange exchange rates. (The first is solid economics. The second is a bit of a stretch. The third is pure fantasy.)